What shaped the past week?

Global: Global investor sentiment was mixed across key markets as market participants digested the latest batch of economic data, as well assessing the latest remarks from U.S. Fed officials. Mr. Kashkari who is a senior banker at the Fed, stated that the central bank may consider halting rate hikes if inflation falls substantiality in 2023, while Fed economist James Bullard argued rates would need to rise to 5%, to bring down inflation.

Starting in the Asian region, investor focus was dampened by renewed tensions on the Korean peninsula, following North Korea’s ballistic missile test on Thursday. The missile test was in response to joint military exercises between the U.S., South Korea, and Japan. Meanwhile on the macro front, the latest inflation data out of Japan, showcased a 3.6% y/y rise in consumer prices, the highest in forty-years.

Moving to the European region, all key markets traded in the green w/w, as investors digested the latest inflation, economic and construction data out of the Eurozone. In the United Kingdom, there was a moderate increase in retail sales slightly for October, while consumer confidence was expected to rebound from historic lows in November.

Finally, in the U.S., recession fears weighed on investor sentiment amid signals of further rate hikes from the U.S. Federal Reserve. U.S. based lender JP Morgan, has forecasted a mild recession in 2023; while treasury yields surged after a senior Federal Reserve official signaled that the central bank’s fight to tame inflation is far from over. James Bullard who is the President of the Federal Reserve Bank of St. Louis President expressed his belief that interest rates have not yet reached “sufficiently restrictive” levels, to bring down inflation.

For the week, European markets were the best performers with the German Dax, French CAC, and London FTSE-100 rising, 1.36%, 0.91%, and 1.03%. Meanwhile, in Asia, where the performance was mixed, the Hang Seng closed higher, up 3.85% w/w, while the Shanghai Composite rose 0.32%; whereas the Japan Nikkei-225 sank 1.56%. Finally, across the U.S., tech stocks were the worst performers with the Nasdaq-100 easing 1.29%, while the S&P 500 lost 0.24% w/w.

For the week, European markets were the best performers with the German Dax, French CAC, and London FTSE-100 rising, 1.36%, 0.91%, and 1.03%. Meanwhile, in Asia, where the performance was mixed, the Hang Seng closed higher, up 3.85% w/w, while the Shanghai Composite rose 0.32%; whereas the Japan Nikkei-225 sank 1.56%. Finally, across the U.S., tech stocks were the worst performers with the Nasdaq-100 easing 1.29%, while the S&P 500 lost 0.24% w/w.

Domestic Economy: Consumer prices increased by 21.09% y/y in October, rising 32bps from the previous month (20.77% y/y). The increase was less-than-anticipated due to the soothing relief of the harvest season. For context, inflation trended downwards on a month-on-month basis to 1.24% m/m (Sept’22: 1.36% m/m), its lowest outturn since November 2021 driven by the ongoing harvest season. We find instructive that the nationwide floods had a muted impact on inflation, as food inflation trended downwards. This connotes that inflation could peak soon. Nevertheless, we see room for higher inflation numbers in the month of November.

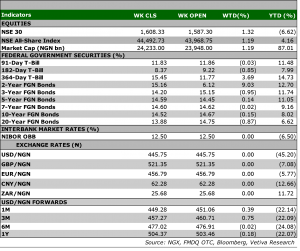

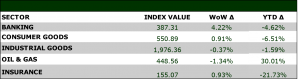

Equities: The local equities market rebounded this week, as renewed interest in the banking space propelled the NGX higher. The NGXASI rose 1.09% w/w, to close at 44,492.75pts, as a surge in interest in the banking sector drove the market’s performance. The sector rose 4.22% w/w, ending the week as the best performer, and its performance was fueled by interest in ZENITHBANK (+7.02% w/w), and other mid-cap names in the space. Likewise, the Consumer Goods sector rebounded this week, on the back of interest in the brewery players. NB rose 10.00% w/w to settle at N41.25, while INTEBREW gained 6.25% w/w, to settle at N4.25. On the other hand, the Oil and Gas space sank 1.34% as a shift in sentiment towards players in the oil marketing space, drag buy-side interest in the sector. Finally, in was a red close for the Industrial Goods space w/w, as losses in WAPCO (-5.62% w/w) saw the sector sink 0.37% w/w.

Equities: The local equities market rebounded this week, as renewed interest in the banking space propelled the NGX higher. The NGXASI rose 1.09% w/w, to close at 44,492.75pts, as a surge in interest in the banking sector drove the market’s performance. The sector rose 4.22% w/w, ending the week as the best performer, and its performance was fueled by interest in ZENITHBANK (+7.02% w/w), and other mid-cap names in the space. Likewise, the Consumer Goods sector rebounded this week, on the back of interest in the brewery players. NB rose 10.00% w/w to settle at N41.25, while INTEBREW gained 6.25% w/w, to settle at N4.25. On the other hand, the Oil and Gas space sank 1.34% as a shift in sentiment towards players in the oil marketing space, drag buy-side interest in the sector. Finally, in was a red close for the Industrial Goods space w/w, as losses in WAPCO (-5.62% w/w) saw the sector sink 0.37% w/w.

Fixed Income: The secondary market traded on a relatively quiet note this week. However, the lower-than-expected inflation result for October sparked some buy-side activity in the bond market, driving average yields down 5 basis points w/w. Similarly, mild bullish sentiments in the NTB and OMO caused average yields to decline by one basis point w/w.

Fixed Income: The secondary market traded on a relatively quiet note this week. However, the lower-than-expected inflation result for October sparked some buy-side activity in the bond market, driving average yields down 5 basis points w/w. Similarly, mild bullish sentiments in the NTB and OMO caused average yields to decline by one basis point w/w.

Currency: The Naira appreciated N0.08 w/w at the I&E FX Window to N445.67.

What will shape markets in the coming week?

Equity market: After several sessions of fluctuating activity this week, positive sentiment ultimately prevailed in the market for a positive close. Next week, we anticipate a slightly bearish start, as investors take profit on some of this week’s gainers.

Fixed Income: In the bond market, we anticipate a quiet start to next week, as investors await the MPC decision on Tuesday. Meanwhile, constrained liquidity levels could drive bearish activity in the T-Bills space.

October 2022 Inflation review - Inflation could be close to peak

In the month of October, headline inflation accelerated to 21.09% y/y (Sep’22: 20.77% y/y), lower than consensus estimate of 21.3% y/y (Vetiva: 21.37% y/y). We attribute the deviation to the sustained passthrough of the ongoing harvest season as the impact of floods on inflation was muted.

Food inflation: Energy pressures tussle with harvest gains

The harvest season continued to provide respite for food supply, with food inflation falling to 1.23% m/m (Sep’22: 1.43% m/m). Due to the low base from the prior year, the underlying energy shock spurred food inflation to 23.72% y/y (Sep’22: 23.34% y/y).

Core inflation remains energy driven

In October, core inflation increased to 17.76% y/y (Sep’22: 17.60%), driven primarily by energy inflation (+32% y/y). The highest pricing pressures were felt in liquid and solid fuels, transportation, and vehicle spare parts. On a month-on-month basis, we observed a decline in core inflation to 0.93% m/m (Sept’22: 1.59% m/m). This could be due to relatively stable electricity supply in the prior month.

Favorable inflation outlook could cause the apex bank to hang its tools

Thus far, consumer prices seem to have adjusted to the new norm – frequent episodes of fuel scarcity and higher pump prices. Thus, we have observed a sustained decline in month-on-month inflation. Our models suggest inflation could be peaking soon, especially as the low-base effect fades gradually. Thus, we see room for further acceleration to 21.33% y/y in November. Our full-year average inflation estimate has also been adjusted to 18.70% y/y (2021: 16.98% y/y).

Given the sustained deceleration in month-on-month inflation and the triple measures taken to curb money demand growth (MPR, CRR, and new Naira notes), we expect the apex bank to maintain interest rates at current levels in the last MPC meeting of the year