A move on Wednesday that saw Nigerian banks using the naira exchange rate at the Investors’ and Exporters’ foreign exchange window was being interpreted as a clear desire by regulators to see a single naira exchange rate enthroned in the country much sooner than earlier thought.

Nigeria currently operates a multiple exchange rate system with five of them officially recognised while there are many other streets or parallel market rates. The officially acknowledged rates are the central bank’s, investor’s and exporter’s rate, Nigerian Autonomous Foreign Exchange Fixing rate (NAFEX), Nigerian Inter-bank Foreign Exchange Fixing (NIFEX) and bureau de change (BDC) rate.

Nigeria banks were asked by FMDQ OTC, the securities exchange platform used for interbank trading, to publish quotes that reflected trades at the Investors’ and Exporters’ foreign exchange window, according to sources at Ecobank and Access Bank referred to by Bloomberg. The window had been introduced by the central bank as part of its measures to tackle an exchange rate that had gotten out of hand.

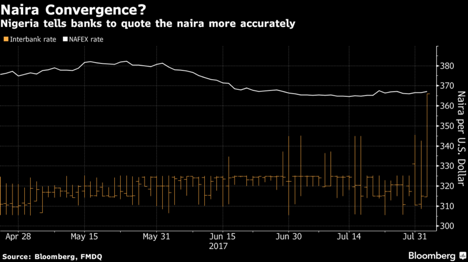

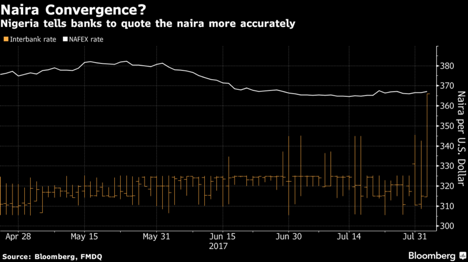

On Wednesday interbank rate went down 14 percent to N366.04 to the dollar late in the trading day. Thursday it was further down when it opened at N366.71 before closing at N367.19 to the dollar. The NAFEX rate is 367.08. This is the daily fixing published by FMDQ for the Investors’ & Exporters’ FX window. Naira three-month forward contracts based on the official rate rose as much as 1.3 percent to 342 against the greenback, the highest level on a closing basis since June 6.

“FMDQ and traders reached an agreement to try to move toward a single exchange rate,” Kunle Ezun, an analyst at Ecobank in Lagos, told Bloomberg by phone. He said the idea behind this was “to show the true reflection of the naira in the market. The I&E window in terms of transparency and price discovery seems to reflect where the naira should trade. All banks are now putting quotes at that rate.”

“FMDQ and traders reached an agreement to try to move toward a single exchange rate,” Kunle Ezun, an analyst at Ecobank in Lagos, told Bloomberg by phone. He said the idea behind this was “to show the true reflection of the naira in the market. The I&E window in terms of transparency and price discovery seems to reflect where the naira should trade. All banks are now putting quotes at that rate.”

“FMDQ and traders reached an agreement to try to move toward a single exchange rate,” Kunle Ezun, an analyst at Ecobank in Lagos, told Bloomberg by phone. He said the idea behind this was “to show the true reflection of the naira in the market. The I&E window in terms of transparency and price discovery seems to reflect where the naira should trade. All banks are now putting quotes at that rate.”

“FMDQ and traders reached an agreement to try to move toward a single exchange rate,” Kunle Ezun, an analyst at Ecobank in Lagos, told Bloomberg by phone. He said the idea behind this was “to show the true reflection of the naira in the market. The I&E window in terms of transparency and price discovery seems to reflect where the naira should trade. All banks are now putting quotes at that rate.”