What shaped the past week?

Global: With Q3’22 season underway across the globe; investors’ focus will be on the latest performance of listed companies across key equity markets. This week started off on a mixed note, as global investors awaited the release of the U.S. inflation data for September. The world’s largest economy saw consumer prices rise 8.22% y/y, as inflationary pressures across food, shelter and energy drove consumer prices higher. Investor sentiment in the region was largely mixed this week, with the NASDAQ down 0.05% w/w, while the Dow Jones and S&P 500 were up 2.58% and 0.73% w/w respectively. Moving to the Asian region, where the focus remains on China’s zero-covid policy, investors were largely bearish this week. The Hang Seng Index sank 6.50% w/w, as investors remain unnerved by the latest plans of the U.S. government to tighten export controls, which aim to cut China off from the American tech market. The new rules require US-based companies to apply for a license to sell semiconductors and chip-making technology to the country, a move heavily criticized by Beijing. Additionally, on the macro front, the Bank of Korea raised its key interest rate by 25bps as it seeks to wrestle down inflation. Finally, across European markets, investor focus was on the latest batch of economic data coming out of the region. the United Kingdom gross domestic product (GDP) fell by 0.3% in August, according to a monthly estimate released by the country’s Office for National Statistics (ONS). On a quarterly basis, the UK economy also contracted by 0.3% in the three months to August compared to the three months to May with production dropping 1.5%. For the week, the German Dax and French CAC rose 1.64 and 1.62%, whereas the London FTSE-100 lost 0.82% w/w.

Domestic Economy: In light of the strengthening dollar, tighter financial conditions, and increased costs of imported goods, the International Monetary Fund adjusted its outlook for Nigeria. In 2022, the Fund expects GDP growth to average 3.2%, down 20bps from its July forecast of 3.4%. On the other hand, it projects inflation to average 18.91% (previously: 16.1%). We believe that the higher inflation estimates are due to reoccurring fuel shortages, food insecurity and exchange rate pressures. This is despite expected relief from harvest, declining global food prices, and reopened borders.

Domestic Economy: In light of the strengthening dollar, tighter financial conditions, and increased costs of imported goods, the International Monetary Fund adjusted its outlook for Nigeria. In 2022, the Fund expects GDP growth to average 3.2%, down 20bps from its July forecast of 3.4%. On the other hand, it projects inflation to average 18.91% (previously: 16.1%). We believe that the higher inflation estimates are due to reoccurring fuel shortages, food insecurity and exchange rate pressures. This is despite expected relief from harvest, declining global food prices, and reopened borders.

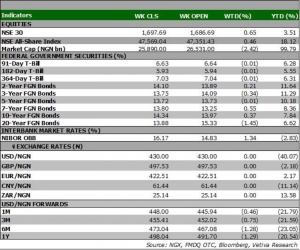

Equities: The local equities space traded in a positive manner w/w, as investors await the release of Q3’22 financial performances of companies listed on the NGX. The market gained 0.46% w/w, on the back of interest in the Industrial Goods and Banking sectors. Starting in the Industrial Goods space, renewed interest in BUACEMENT (+8.65% w/w), drove the sector’s performance, as it rose 3.17% w/w. Similarly, in the Banking space, interest in the tier-I space, propelled the sector higher as it rose 1.93% w/w; notably, ZENITHBANK, ACCESSCORP, and UBA all closed in the green w/w, rising 2.30%, 5.26%, and 2.22% w/w respectively. On the other hand, losses observed in power generator GEREGU, weighed on the performance of the oil and gas space, which sank 2.13% w/w. Finally, in the Consumer Goods space, losses in mid-low cap players in the sector, led to a 0.74% loss in the sector.

Fixed Income: Fixed income markets traded on a relatively quiet note this week as investors continued to trade cautiously and system liquidity remained tight. In the bond market, however, we saw some selloffs across benchmark bonds, which raised average yields 13bps w/w. Meanwhile, minimal activity in the NTB segment resulted in average yields falling 1bp w/w.

Fixed Income: Fixed income markets traded on a relatively quiet note this week as investors continued to trade cautiously and system liquidity remained tight. In the bond market, however, we saw some selloffs across benchmark bonds, which raised average yields 13bps w/w. Meanwhile, minimal activity in the NTB segment resulted in average yields falling 1bp w/w.

Currency: The Naira depreciated 266bps w/w at the I&E FX Window to N439.17.

What will shape markets in the coming week?

Equity market: Another positive outing today, this time with improvement in market sentiment. While we still expect cautious trading sessions next week, we are likely to see more cherry-picking action across board.

Fixed Income: To start the week, we anticipate tepid trading in the bonds segment, as the monthly bond auction takes center stage, while we expect liquidity levels to dictate participation in the T-bills space.

Fixed Income: To start the week, we anticipate tepid trading in the bonds segment, as the monthly bond auction takes center stage, while we expect liquidity levels to dictate participation in the T-bills space.

Q4’22 FX Outlook - SSA Currencies: On the twin edge of the cliff

So far in 2022, African currencies have been on a cliff, no thanks to the war in Ukraine. In recent times, the tension has escalated with the West imposing price caps on Russia’s energy prices. This, combined with the reduction of OPEC+ quota and depletion of the US Strategic Petroleum Reserve, could result in elevated oil prices in Q4’22. With these events spurring oil prices higher, net-oil importers (Kenya, South Africa, Ghana) could reel under high gasoline prices. Economies that export consumer-discretionary items such as flowers (as in the case of Kenya), may suffer from lower external demand, as trading partners undergo demand destruction. Countries that export inelastic commodities such as oil (as Angola and Nigeria) could benefit from the foreseeable uptick in energy prices. While crude theft continues to trample on the export potential of Nigeria, the recent discovery of an illegal 4-kilometre pipeline and loading port lends some hope to crude production recovery.

Away from the merchandise trade channel, the increasing hawkishness of leading central banks could contribute to currency weakness across African sovereigns. For context, the US Fed and European Central Banks raised their policy rates by 75bps each in September, while the Bank of England raised its benchmark rate by 50bps. This extended season of rate hikes leads to further risk aversion as African Eurobond yields spike, shutting out African sovereigns (Kenya, Ghana, and Nigeria) from the international debt market.

In Q4, we expect petrocurrencies to remain protected by elevated oil prices. The Nigerian Naira could however remain under pressure should crude theft continue to erode gains from high oil prices. In the parallel market, while the Naira could receive a year-end boost from remittances, the electioneering season could keep demand for the greenback elevated. The South African Rand could remain under the weather as a hawkish Fed keeps up with rate increases to rein in inflation.