What shaped the past week?

Global: Global markets extended last week’s really into a second consecutive week as investors reacted favorably to the latest inflation numbers out of the United States. While core inflation in the US remained unchanged at 5.9%, headline inflation dipped to 8.5% y/y as a cheaper gasoline and other fuel prices saw inflation moderate 0.2% m/m. Investor sentiment across the EU region was largely buy-side driven, with the French CAC and German DAX rising 3.29% and 3.61% as interest in the tech and consumer goods spaces drove their performance.

Meanwhile, a report from Fitch Ratings, indicated that the global pandemic-related supply chain disruptions have started to ease in the past couple of months as “shipping rates fall, consumer durable spending slows, order backlogs are cleared and queues at ports ease” suggesting that core goods (excluding energy) inflation will likely decline in the coming period. Moving the Asian-pacific region, new lockdowns in China as the country combats new covid cases, dampened sentiment in the region; the Shanghai Composite Index close marginally lower sinking 0.17%, while the South Korean Kospi and the Australian ASX closed 3.81% and 2.63% higher w/w. Finally, in the United States, as earlier stated the region saw an uptick in positive sentiment as investors digested the latest inflation numbers. Investors were particularly upbeat over the drop in gasoline prices, which have a bigger weight than other goods and services in the U.S. CPI basket. As a result, the NASDAQ was up 5.11% w/w, the best performer in the region, while the Dow Jones and S&P 500 rose 3.03% and 3.95% respectively.

Meanwhile, a report from Fitch Ratings, indicated that the global pandemic-related supply chain disruptions have started to ease in the past couple of months as “shipping rates fall, consumer durable spending slows, order backlogs are cleared and queues at ports ease” suggesting that core goods (excluding energy) inflation will likely decline in the coming period. Moving the Asian-pacific region, new lockdowns in China as the country combats new covid cases, dampened sentiment in the region; the Shanghai Composite Index close marginally lower sinking 0.17%, while the South Korean Kospi and the Australian ASX closed 3.81% and 2.63% higher w/w. Finally, in the United States, as earlier stated the region saw an uptick in positive sentiment as investors digested the latest inflation numbers. Investors were particularly upbeat over the drop in gasoline prices, which have a bigger weight than other goods and services in the U.S. CPI basket. As a result, the NASDAQ was up 5.11% w/w, the best performer in the region, while the Dow Jones and S&P 500 rose 3.03% and 3.95% respectively.

Domestic Economy: According to the Organization of Petroleum Exporting Countries (OPEC) monthly report, Nigeria’s crude oil production (excluding condensates) averaged 1.08 million bpd in July. This represents a 74,000 bpd decrease from June’22 output and is far below OPEC’s allocated production quota of 1.8 million bpd. Since the beginning of the year, Nigeria’s oil production has been on a downward slope. Oil production through the Trans-Forcados terminal, the country’s largest oil production facility, has decreased by 49% YTD. We attribute the overall decline to pipeline vandalism and crude theft. Nigeria has not fully capitalized on the benefits of the elevated oil prices that have persisted throughout the year due to low output levels. As a result, the apex bank had to resort to non-oil export-enabling policies to curb volatility in FX inflows.

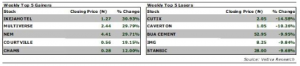

Equities: Nigerian equities saw another week of sell-side action as investors remain risk averse across the space. The market sank 2.09% w/w, primarily driven by investor apathy in across the Industrial Goods space. The sector saw broad based selloffs across the space, drag its performance, as Dangote Cement and Lafarge Africa lost 2.34% and 1.96% as investors react to their latest earnings. Likewise, in the Banking Space, losses in key names saw the sector sink 89bps w/w, with ZENITHBANK and UBA easing 2.97% and 2.76% respectively. On the other hand, investors were keen on counters in the consumer goods space, as the sector rose 3.00% w/w. Of note, BUAFOODS recorded a strong performance rising 10.00% w/w, with FLOURMILL, DANGSUGAR, and GUINNESS rising 1.41%, 1.21% and 1.20% respectively. Finally, in the Oil and Gas space, losses by players in the oil marketing space saw the sector dip 37bps; particularly, ARDOVA saw its share price fall 3.85% as investors reacted to its less than stellar H1’22 earnings results.

Equities: Nigerian equities saw another week of sell-side action as investors remain risk averse across the space. The market sank 2.09% w/w, primarily driven by investor apathy in across the Industrial Goods space. The sector saw broad based selloffs across the space, drag its performance, as Dangote Cement and Lafarge Africa lost 2.34% and 1.96% as investors react to their latest earnings. Likewise, in the Banking Space, losses in key names saw the sector sink 89bps w/w, with ZENITHBANK and UBA easing 2.97% and 2.76% respectively. On the other hand, investors were keen on counters in the consumer goods space, as the sector rose 3.00% w/w. Of note, BUAFOODS recorded a strong performance rising 10.00% w/w, with FLOURMILL, DANGSUGAR, and GUINNESS rising 1.41%, 1.21% and 1.20% respectively. Finally, in the Oil and Gas space, losses by players in the oil marketing space saw the sector dip 37bps; particularly, ARDOVA saw its share price fall 3.85% as investors reacted to its less than stellar H1’22 earnings results.

Fixed Income: With liquidity remaining constrained throughout the week, the fixed income space saw bearish sentiments across all three segments of the market. In the bonds space, investor sentiment was largely bearish, with sell-side activity dominating the short end of the curve. Given this, average yield on benchmark bonds was up 31bps w/w. Similarly, the NTB and OMO markets saw strong sell-side action across both spaces thus, yields rose 79bps w/w and 195bps w/w respectively.

Fixed Income: With liquidity remaining constrained throughout the week, the fixed income space saw bearish sentiments across all three segments of the market. In the bonds space, investor sentiment was largely bearish, with sell-side activity dominating the short end of the curve. Given this, average yield on benchmark bonds was up 31bps w/w. Similarly, the NTB and OMO markets saw strong sell-side action across both spaces thus, yields rose 79bps w/w and 195bps w/w respectively.

Currency: The Naira closed flat w/w at the I&E FX Window at ₦429.00.

What will shape markets in the coming week?

Equity market: Market closed the week down as declines in large cap names like MTNN, BUACEMENT and DANGCEM dragged the All-Share index down. We expect the market to pick up from Friday’s close amid slight recoveries in some of the week’s losers.

Fixed Income: Next week, we anticipate a tepid session in the bonds space, as the bond auction takes center stage. Meanwhile, we expect bearish sentiment to persist in the NTB segment as the rate uptick at the last auction continue to dictate sentiment.

TOTALENERGIES MARKETING PLC - Margins remain pressured amidst rising landing costs

For the half year period, Total’s topline performance was impressive, as the company reported a 38% y/y increase in revenue to print at N209.1 billion (Vetiva: N200.7 billion). Revenue growth was driven by improved sales from both its fuel and lubricants segments. TotalEnergies saw its fuel business post strong double-digit growth of 29% y/y, as we believe rising prices for Diesel and Aviation fuels during the period drove sales. Meanwhile, the lubricants business was favoured by higher pricing and as such, the segment saw turnover come in 66% higher y/y. For Q2, the company’s topline performance was also notable, coming in 30% higher y/y. As noted above, we believe Q2 revenue growth was driven by higher pricing in the diesel and Jet-fuel space, as both segments saw price increases of 10% and 26% q/q respectively. Given this, the fuel business segment posted one of the best performances in a quarterly period, up 24% y/y and 13% q/q.

H1 performance dragged by lower margins in Q2

While TotalEnergies was able to grow revenue, profitability margins took a hit for the second consecutive quarter, dragging H1’22 gross margin 3ppts lower to 14% (Q1’22: 15%, H1’21: 17%). Following the first quarter pattern, Q2 saw landing costs trend higher and given this, we saw cost of sales move faster than revenue growth, resulting in margins contracting y/y (Q2’22: 14%, Q2’21: 17%). For more context, while revenue grew 30% y/y and 14% q/q, cost of sales was up 36% y/y and 16% q/q. Thus, despite strong topline expansion in the Q2 period, gross profit only saw a 9% increase y/y. However, for the H1 period, gross profit saw a 17% y/y increase, as Q1 performance helped cushion the effect of the weak margins in Q2. All in, gross profit came in at ₦29.8 billion for the H1 period.

Moving on, we saw operating expenses trend 20% higher y/y, this coupled with lean gross margin caused Operating profit to only expand by 9% y/y to ₦13.5 billion in the H1 period, despite the strong revenue growth. Meanwhile, finance costs trended 2x higher y/y, as the company took on fresh loans to finance working capital needs given its strained cash position. Consequently, net profit for the H1 period came in at N8.5 billion (Vetiva: N9.0 billion), up 6% y/y.

PMS prices quietly reviewed, although cap remains

Recently, various fuel retail outlets put up new pricing for PMS at N179/ litre as the ex-depot price had trended upwards to N167/litre, although no official statement has been put up by regulatory authorities. With this review, we expect the pressure on margins to ease. Therefore, for subsequent quarters, we project fuel turnover to come in 22% higher y/y at N311.00 billion, as we anticipate further price increases in the diesel and aviation fuel segment. Also, we expect higher pricing to drive turnover for the lubricants segment and project 48% y/y increase for the business to come in at N127.8 billion. Meanwhile, we maintain our expectations for gross margin at 15% despite the consistent decline in the last two quarters, as the PMS price review is expected to cushion margins, given a wider spread between the ex-depot price and retail price. This brings our 2022 gross profit expectation to N64.9 billion (up 18% y/y). We also expect operating profit margin to print at 7%, bringing FY’22 operating profit to N29.8 billion. Finally, given that cash from operating activities appears strained (H1’22: -N25.4 billion, H1’21: N25.5 billion), we have revised our projections for finance cost upwards to N2.9 billion (previous: N1.4 billion). Therefore, our forecast for net profit comes to N18.5 billion. We value TotalEnergies at ₦318.21 and rate the stock a BUY.