The Nigerian economy has potential of growing by as much as 12 percent in less than a decade if the government takes heed to a new report by McKinsey Global Institute (MGI) and broaden the country's access to digital finance tools, including having payments and financial services delivered via the phone and the Internet.

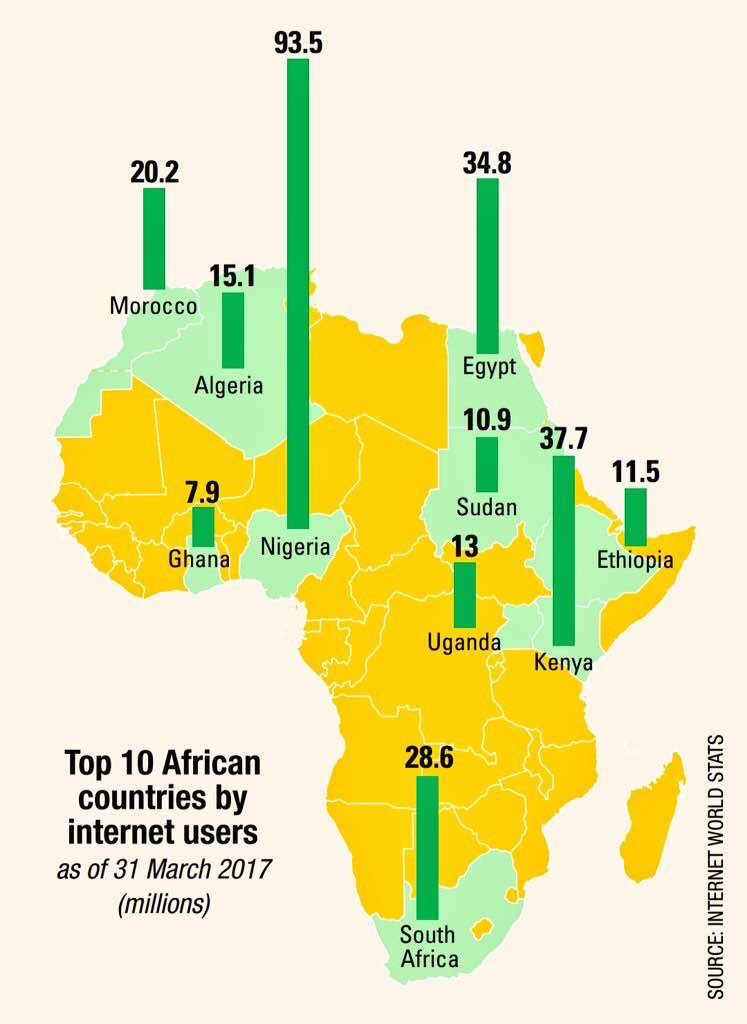

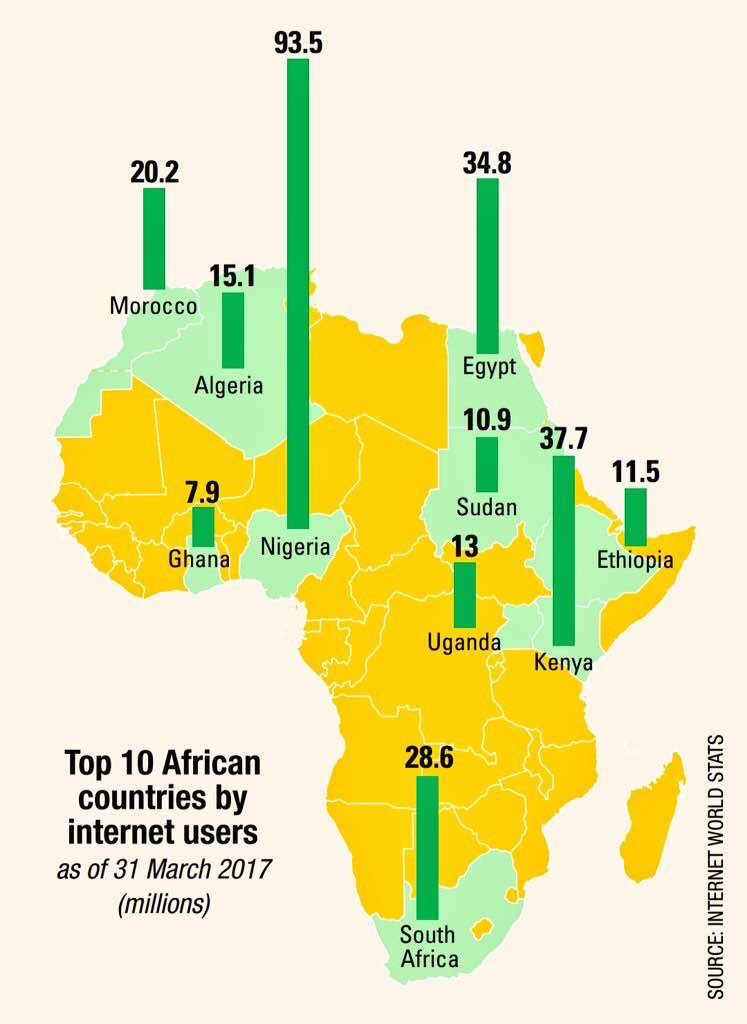

Nigeria is the biggest country in Africa by population and economy size and also leads the continent in the number of active mobile phone lines and number of Internet users, but would require a well articulated policy push in digital finance, where it has struggled to set a proper framework its operation, for it to achieve the McKinsey projected growth number.

A new report, "Digital finance for all: Powering inclusive growth in emerging economies", one of the first attempts to quantify the full impact of digital finance, asserts that delivering financial services by mobile phone could benefit billions of people by spurring inclusive growth that adds $3.7 trillion to the GDP of emerging economies within a decade.

“The economic potential varies significantly, depending on a country’s starting position. Lower-income countries such as Ethiopia, India, and Nigeria have the largest potential, with the opportunity to add 10 to 12 percent to their GDP, given low levels of financial inclusion and digital payments today,” the report highlighted.

It said that Pakistan has a somewhat lower GDP potential, at seven percent, while Middle-income countries such as Brazil, China, and Mexico could add 4 to 5 percent to GDP—still a substantial boost. The report noted that two billion individuals and 200 million micro, small, and midsize businesses in emerging economies today, lack access to savings and credit, that even those with access often pay high fees for a limited range of products while economic growth suffers.

“But a solution is right in people’s hands: a mobile phone,” it said, adding that digital finance—payments and financial services delivered via mobile phones and the Internet—could transform the lives and economic prospects of individuals, businesses, and governments across the developing world, boosting GDP and making the aspiration of financial inclusion a reality.

According to the report, digital payments and financial services are part of the vital infrastructure of a modern economy, enabling individuals, businesses, and governments to transact cheaply and efficiently.

“For a range of companies, including banks, telecommunications companies, payments providers, financial-technology startups, retailers, and others, the potential business opportunity is large. In most countries, which players will dominate, is still up for grabs,” the report noted, adding that the opportunity to accelerate inclusive growth could be addressed rapidly and without the need for major investment in costly additional infrastructure.

In addition to extensive economic modeling, the report draws on the findings of field visits to seven countries—Brazil, China, Ethiopia, India, Mexico, Nigeria, and Pakistan—and more than 150 expert interviews. It also lays out the key conditions that will need to be met to capture the benefits.

The report noted that two billion individuals and 200 million micro, small, and midsize businesses in emerging economies today, lack access to savings and credit, that even those with access often pay high fees for a limited range of products while economic growth suffers.

“But a solution is right in people’s hands: a mobile phone,” it said, adding that digital finance—payments and financial services delivered via mobile phones and the Internet—could transform the lives and economic prospects of individuals, businesses, and governments across the developing world, boosting GDP and making the aspiration of financial inclusion a reality.

According to the report, digital payments and financial services are part of the vital infrastructure of a modern economy, enabling individuals, businesses, and governments to transact cheaply and efficiently.

“For a range of companies, including banks, telecommunications companies, payments providers, financial-technology startups, retailers, and others, the potential business opportunity is large. In most countries, which players will dominate, is still up for grabs,” the report noted, adding that the opportunity to accelerate inclusive growth could be addressed rapidly and without the need for major investment in costly additional infrastructure.

In addition to extensive economic modeling, the report draws on the findings of field visits to seven countries—Brazil, China, Ethiopia, India, Mexico, Nigeria, and Pakistan—and more than 150 expert interviews. It also lays out the key conditions that will need to be met to capture the benefits.

The report noted that two billion individuals and 200 million micro, small, and midsize businesses in emerging economies today, lack access to savings and credit, that even those with access often pay high fees for a limited range of products while economic growth suffers.

“But a solution is right in people’s hands: a mobile phone,” it said, adding that digital finance—payments and financial services delivered via mobile phones and the Internet—could transform the lives and economic prospects of individuals, businesses, and governments across the developing world, boosting GDP and making the aspiration of financial inclusion a reality.

According to the report, digital payments and financial services are part of the vital infrastructure of a modern economy, enabling individuals, businesses, and governments to transact cheaply and efficiently.

“For a range of companies, including banks, telecommunications companies, payments providers, financial-technology startups, retailers, and others, the potential business opportunity is large. In most countries, which players will dominate, is still up for grabs,” the report noted, adding that the opportunity to accelerate inclusive growth could be addressed rapidly and without the need for major investment in costly additional infrastructure.

In addition to extensive economic modeling, the report draws on the findings of field visits to seven countries—Brazil, China, Ethiopia, India, Mexico, Nigeria, and Pakistan—and more than 150 expert interviews. It also lays out the key conditions that will need to be met to capture the benefits.

The report noted that two billion individuals and 200 million micro, small, and midsize businesses in emerging economies today, lack access to savings and credit, that even those with access often pay high fees for a limited range of products while economic growth suffers.

“But a solution is right in people’s hands: a mobile phone,” it said, adding that digital finance—payments and financial services delivered via mobile phones and the Internet—could transform the lives and economic prospects of individuals, businesses, and governments across the developing world, boosting GDP and making the aspiration of financial inclusion a reality.

According to the report, digital payments and financial services are part of the vital infrastructure of a modern economy, enabling individuals, businesses, and governments to transact cheaply and efficiently.

“For a range of companies, including banks, telecommunications companies, payments providers, financial-technology startups, retailers, and others, the potential business opportunity is large. In most countries, which players will dominate, is still up for grabs,” the report noted, adding that the opportunity to accelerate inclusive growth could be addressed rapidly and without the need for major investment in costly additional infrastructure.

In addition to extensive economic modeling, the report draws on the findings of field visits to seven countries—Brazil, China, Ethiopia, India, Mexico, Nigeria, and Pakistan—and more than 150 expert interviews. It also lays out the key conditions that will need to be met to capture the benefits.